Unlocking OSMO: The Future of Cross-Chain Trading

Share

Understanding the Use Cases of OSMO: Exploring Osmosis

Osmosis (OSMO) is a prominent decentralized exchange (DEX) that forms an integral part of the Cosmos ecosystem, focusing on enabling seamless cross-chain trading. As an application-specific blockchain built with the Cosmos SDK, Osmosis uses a proof-of-stake consensus mechanism to ensure transactions are validated while maintaining a degree of decentralization suited for scalable trading operations.

Liquidity Pools and Token Swaps

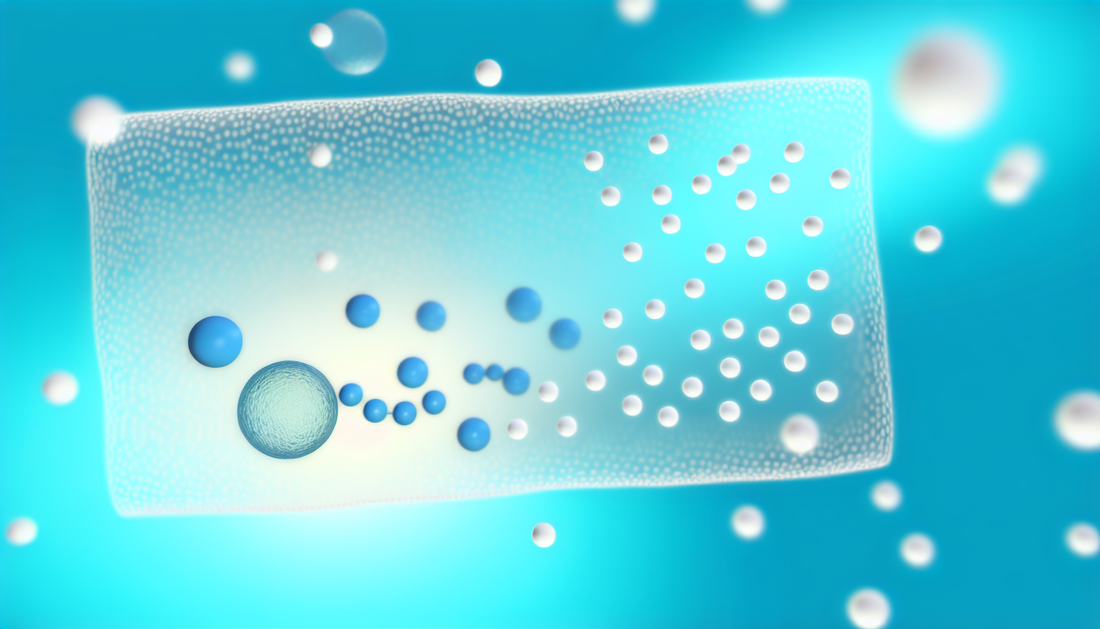

One of Osmosis's primary use cases lies within its liquidity pools, which allow users to contribute tokens and earn rewards. These pools are essential for the functioning of the exchange, as they provide the necessary liquidity for users to swap tokens across different blockchains effectively. The ability to handle multiple tokens in pools underscores Osmosis's aim of simplifying the decentralized finance (DeFi) experience by eliminating complex third-party intermediation using its secure platform.

Dynamic Fee Structure

Osmosis features a dynamic fee structure that adjusts according to market demand. This versatility allows liquidity providers to set their fees, giving them the autonomy to optimize their returns based on market conditions. This approach attracts a diverse range of traders who seek to minimize costs while maximizing investment efficiencies.

Interchain DeFi

Osmosis is renowned for its interchain DeFi capabilities, bridging blockchains within the Cosmos network and beyond. By supporting IBC (Inter-Blockchain Communication) protocols, it facilitates interactions between different blockchain networks, effectively broadening the scope of what decentralized exchanges can achieve. This capability emphasizes Osmosis's role in a cross-chain ecosystem, aiming to make various blockchain interactions more seamless and intuitive.

Customizable AMM Algorithms

The platform allows users to create customizable Automated Market Maker (AMM) algorithms. These AMMs enable traders to explore varied pool structures, each offering specialized functionalities tailored to specific trading strategies. This flexibility is a significant draw for DeFi enthusiasts seeking innovative and personalized trading experiences.

Governance and Community Involvement

Decentralized governance within Osmosis is another critical use case. Token holders have the power to participate in decision-making processes, impacting matters such as protocol upgrades and community initiatives. This governance model ensures that users have a stake in the platform's development and adaptation, fostering a community-centric environment.

Osmosis continues to appeal to those enthusiastic about decentralized finance's future by emphasizing secure, efficient, and user-centric trading opportunities across varied blockchain networks. For those interested in other innovative DeFi solutions, you might explore the unique governance model of Liquity, which also emphasizes user involvement in decentralized finance.

As the DeFi landscape evolves, Osmosis stands out for its robust use cases that collectively encourage active participation and innovation within the blockchain space.

For further exploration into decentralized finance and blockchain's innovative use cases, register on Binance to start your trading journey.