Osmosis (OSMO): Navigating the DeFi Landscape

Share

Examining the Data on Osmosis (OSMO): A Neutral Perspective

Osmosis (OSMO) is a prominent decentralized exchange (DEX) operating in the Cosmos ecosystem. The platform is designed to allow users to create, manage, and swap liquidity pools about assets such as OSMO. In recent times, Osmosis has been examined closely for its innovative use of Inter-Blockchain Communication (IBC) to facilitate cross-chain transactions.

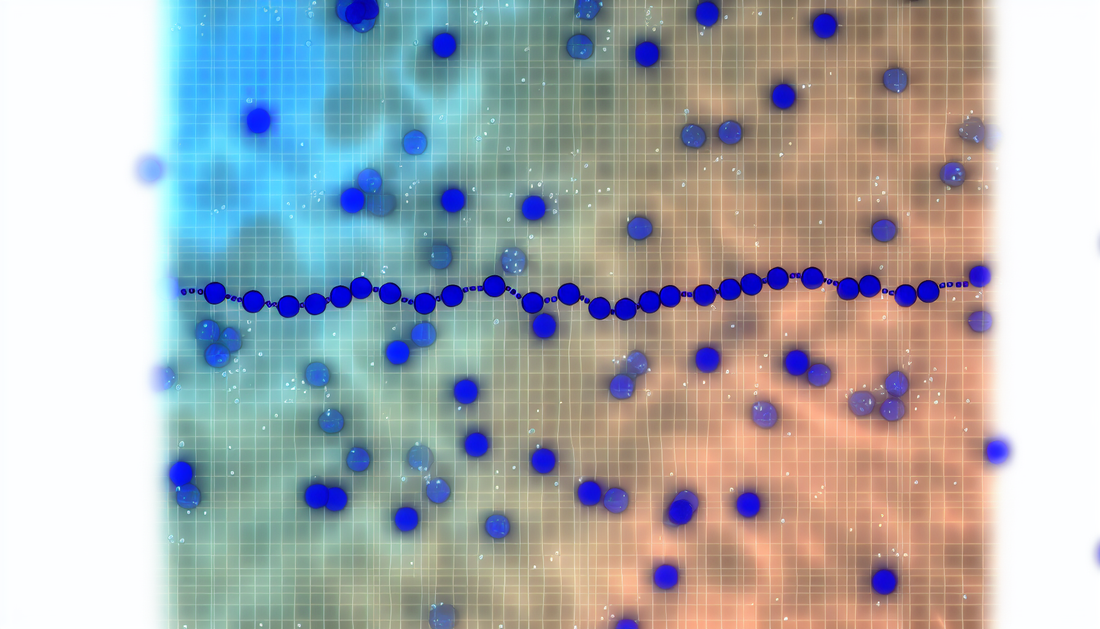

Several data points can help us understand Osmosis's current state in the DeFi landscape. One critical aspect is the volume of liquidity pools. Osmosis has gained notoriety for having numerous active liquidity pools, which provide varying degrees of rewards for liquidity providers, based primarily on pool activity and trade frequency.

Staking data also offers insight into user engagement within the Osmosis platform. Holding and staking OSMO are key actions within the ecosystem, offering governance rights and staking rewards. The number of tokens staked can indicate community trust and engagement, crucial for any DEX aiming for long-term sustainability.

Additionally, user traffic and transaction data can be an indicator of platform health. Osmosis has shown a pattern of growing daily active users, reflecting a robust interest in DeFi projects that offer secure, cross-chain capabilities. However, fluctuations in this data can result from broader market trends affecting DeFi participation globally.

The Comparative Landscape

Looking at Osmosis within the broader DeFi environment, it's pivotal to assess its interoperability edge. The Cosmos ecosystem's design inherently offers solutions to cross-chain interactions, potentially setting Osmosis apart from other DEXs limited by single blockchain networks. A close comparison could be drawn with projects such as the Zilliqa network, which explores unique use cases within blockchain scalability.

Analyzing Challenges

Despite its promises, Osmosis must navigate challenges surrounding liquidity depth and security, common pain points that can affect all DEXs. The platform must continuously attract liquidity providers to maintain optimal trading conditions while ensuring the security protocols are robust enough to prevent vulnerabilities, a concern similarly expressed in platforms such as Arbitrum.

These data points are essential in understanding not only the state of Osmosis today but also its potential trajectory in an ever-evolving DeFi sector. While OSMO shows promise, analyzing its data remains crucial as users and investors make informed decisions. For those exploring the cryptocurrency landscape, platforms like Binance offer diverse opportunities to explore assets like OSMO. Join Binance today to explore Osmosis and other crypto assets.