A Deepdive into VELO - 2025

Share

History of VELO

VELO: A Look Into Its History and Evolution

VELO, a digital asset within the blockchain ecosystem, has a history deeply rooted in its ambition to disrupt the traditional financial infrastructure. Its origins trace back to its association with Velo Labs, an organization aimed at bridging the gap between traditional financial institutions and decentralized technologies, primarily through the facilitation of cross-border asset transfers. From inception, the primary focus of VELO was clear: to serve as a critical utility within a compliance-driven, blockchain-based financial framework.

The launch of VELO came with significant backing, both in terms of partnerships and technological ambition. Early on, the project positioned itself as a hybrid solution, blending elements of blockchain-based programmability with an infrastructure designed to meet stringent compliance standards. A key milestone in its history was the integration with the Stellar blockchain, chosen for its ledger's capacity to settle cross-border transactions quickly and at low cost. This integration solidified VELO's role in creating trustless bridges for fiat and crypto-denominated assets alike.

One important design aspect in VELO's evolution has been its collateralized value backing through the Velo Protocol. This system introduced "digital credit issuance," a mechanism that allowed businesses to collateralize VELO tokens to issue fiat-pegged credits for international settlements. While innovative, this approach raised concerns from some within the crypto community over the token’s inflation model. Specifically, skepticism emerged about whether the issuance structure could sustain long-term demand for VELO tokens without diluting holders' value.

Further, VELO's early history reflected a strategic push for institutional adoption rather than broad retail use. Early adoption partners included payment processors, remittance services, and financial service providers, particularly in Southeast Asia—a region with a high reliance on remittance flows and a fragmented financial infrastructure. However, critics argued that this narrow regional focus might limit the scalability and adoption of VELO beyond specific corridors, potentially slowing down its global adoption roadmap.

Regulatory compliance has played a pivotal role in shaping VELO's trajectory, with the team working to adhere to strict anti-money laundering (AML) and Know Your Customer (KYC) protocols. While this focus has earned respect among regulatory-conscious institutions, it has also alienated parts of the decentralized finance (DeFi) community, particularly those who prize complete anonymity and censorship resistance in blockchain systems.

VELO's history is one of ambition, innovation, and trade-offs, born from its dual mission of compliance and decentralization. It provides a case study in navigating the challenges of bridging two very different financial paradigms.

How VELO Works

How VELO Works: Tokenized Liquidity and Cross-Chain Settlements

VELO operates as a blockchain-based utility token within the Velo Protocol, a decentralized financial infrastructure designed to enable seamless cross-border transactions and credit exchange. At its core, VELO leverages a combination of cryptographic mechanisms, smart contracts, and a unique collateral-backed issuance model to ensure liquidity and asset stabilization.

Token Utility and Collateralized Issuance

VELO tokens are primarily used as a reserve to collateralize digital credit issuance. Participants on the network, mainly financial institutions, deposit VELO tokens into a smart contract-based system to mint digital credits that are pegged to fiat currencies or other real-world assets. These digital credits act as stable, transactable units that facilitate remittance and business-to-business payments across borders. The collateralization model ensures that the digital assets issued are backed by real value, reducing volatility within the system. However, one challenge here is the dependency on the collateral's effectiveness and transparency, as any mismanagement of reserves could impact trust and functional liquidity.

Federated Credit Exchange and Smart Routing

The Velo Protocol employs a Federated Credit Exchange model, which allows trusted parties, often referred to as “federated partners,” to issue and redeem digital credits. The platform uses smart routing powered by decentralized algorithms to match the most efficient pathways for cross-border currency swaps. While this mechanism reduces dependency on intermediaries and increases transaction efficiency, there is inherent complexity in onboarding and maintaining federated partners. This introduces potential bottlenecks if centralized control or misaligned incentives slow down the decentralized nature of the ecosystem.

Layer-1 Blockchain and Compatibility

VELO is built on the Stellar blockchain, leveraging its scalability, low transaction costs, and fast settlement speeds. This provides network users with a high-performance infrastructure for cross-border payment solutions. VELO tokens are natively designed to integrate seamlessly with the Stellar Consensus Protocol (SCP), facilitating interoperability and ecosystem-wide compatibility. However, reliance on Stellar could pose scalability issues if the underlying Layer-1 network encounters congestion or technical vulnerabilities.

Liquidity and Market Dynamics

VELO tokens are designed to ensure liquidity across the protocol by incentivizing holders through staking and participation rewards. These mechanisms align user behavior with maintaining network functionality but create secondary concerns around token dumping and liquidity fragmentation. Additionally, over-reliance on staking rewards may attract speculative behavior, potentially undermining the protocol's core utility-based vision.

By decentralizing credit allocation and enabling efficient cross-border settlements, VELO introduces an ambitious framework. Nevertheless, its operational success hinges heavily on maintaining network decentralization, partner participation, and reserve stability.

Use Cases

Exploring the Use Cases for VELO: A Specialized Crypto Asset

VELO is a digital asset designed with a specific set of use cases focused on optimizing cross-border transactions and liquidity provision. At its core, the VELO token operates within the Velo Protocol, a framework aiming to facilitate borderless financial services. Below, we delve into the practical applications of VELO, as well as the challenges and limitations it faces in these domains.

1. Cross-Border Settlements

VELO is primarily utilized as a bridge asset for cross-border settlement processes in a bid to minimize friction and costs compared to traditional banking systems. Through its decentralized architecture, VELO enables instant value transfers between participating entities without the need for pre-funded accounts. This model is particularly appealing for remittance services, business-to-business (B2B) payments, and financial institutions looking to streamline currency conversions. However, adoption of VELO for this purpose is tied to network effects—its effectiveness hinges on the participation of partner organizations and their integration with the protocol.

2. Credit Issuance via Digital Credit Contracts

Another significant use case for VELO lies in its role in a unique credit issuance model. By locking VELO tokens as collateral, organizations or businesses can mint digital credits pegged to fiat currencies. These credits are used for various transactional purposes while ensuring stable value representation. This design aims to achieve interoperability between crypto and traditional financial systems. However, questions remain about scalability and demand, as the need for fiat-pegged digital credits depends heavily on market trust in the system's stability and adoption by liquidity providers.

3. Liquidity Provision

VELO is also leveraged within liquidity pools to facilitate conversions across multiple currencies or assets. In this capacity, it lowers the need for intermediaries and provides operational efficiencies for participants. Yet, the role of VELO in liquidity ecosystems is not without complications. For instance, providing liquidity through VELO can expose users to impermanent loss and dependency on market dynamics, which might deter risk-averse participants from participating fully.

4. Limitations in Adoption and Integration

While VELO offers promising avenues for mechanics such as tokenized credit issuance and decentralized settlements, its practical adoption faces challenges. Regulatory barriers in various regions could hinder its integration into wide-scale financial systems. Furthermore, the need for seamless adoption by institutional players remains a critical bottleneck, as uptake is often slowed by the technical and procedural hurdles involved in adopting a blockchain-based solution.

In summary, VELO's use cases showcase its potential to solve specific inefficiencies in financial systems. However, its dependency on adoption by external entities and exposure to market risk highlight areas where further development and ecosystem maturity are required.

VELO Tokenomics

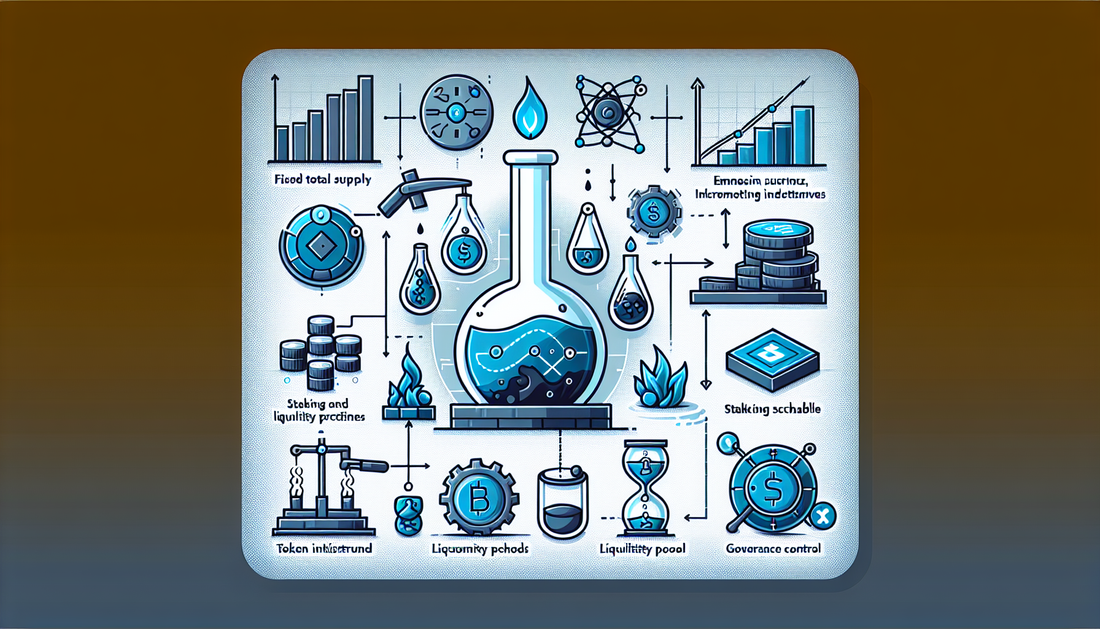

VELO Tokenomics: A Deep Dive into Supply Mechanics and Incentive Structures

VELO operates as the native utility token within the Velo Protocol, underpinning its infrastructure and use cases. Central to its tokenomics are factors that influence supply distribution, staking mechanics, and incentive alignments for the ecosystem's participants.

Fixed Total Supply and Emission Schedule

VELO’s total token supply is fixed, a feature designed to limit inflationary pressures over time. However, the distribution of these tokens is tiered strategically through various mechanisms. Initially allocated during pre-mining and vesting stages, a sizeable portion of the tokens is reserved for ecosystem initiatives, partnerships, and protocol rewards. While these allocations aim to foster network growth, large pre-mined allocations have raised concerns about centralized supply control, particularly among early backers and institutional stakeholders.

This pre-mined structure places significant emphasis on trust in the project’s roadmap and governance. Savvy investors rightfully flag that the release schedule must be monitored closely to avoid supply shocks caused by unlocking events.

Staking and Utility Incentives

VELO tokens are primarily utilized for staking within the Velo ecosystem, which serves multiple purposes. Firstly, staking contributes to governance participation, giving token holders a proportional voice in decision-making processes. Secondly, it secures liquidity pools in the protocol’s decentralized financial (DeFi) mechanisms, such as the issuance of digital credits pegged to fiat currencies.

Token stakers are incentivized via rewards issued in VELO, distributed according to pre-determined inflation metrics. While this aligns incentives for liquidity providers and protocol users, there have been debates within the community over the sustainability of these reward models. Critics argue that high-staking rewards may encourage speculative behavior over long-term utility adoption. Additionally, token inflation through staking rewards could dilute value for holders, especially if protocol usage does not scale accordingly.

Token Burn Mechanism

VELO incorporates a burn mechanism tied to transaction fees and certain usage scenarios within the protocol. This deflationary feature is designed to counteract inflationary token emissions, maintaining equilibrium in token supply over time. However, the extent of token burns is highly dependent on protocol adoption and network activity. Limited usage could result in lower burn rates, undermining the deflationary effects and potentially leaving the market oversupplied.

Governance and Control

Another significant aspect of VELO’s tokenomics is governance control. While token holders are granted governance rights, critics have noted the potential for power concentration among whales or early investors due to initial allocation structures. This raises concerns about a disproportionate influence in key decision-making, which could alienate smaller holders from meaningful participation.

In summary, VELO’s tokenomics present a multi-faceted approach to incentivizing participation and maintaining a balanced token economy but are not without challenges related to centralization and sustainability.

VELO Governance

Governance Structure of VELO: Decentralization and Challenges

The governance framework of VELO is centered on enabling decentralized decision-making while maintaining operational efficiency for the protocol. As a utility-focused crypto asset designed to facilitate cross-border payments and liquidity provisioning, the governance model plays a critical role in directing platform upgrades, parameter adjustments, and broader ecosystem development.

On-Chain Governance Mechanism

VELO governance relies on its decentralized on-chain voting system, which empowers token holders to influence the protocol’s decision-making processes. The governance structure typically operates through a proposal-and-vote mechanism, where initiatives such as modifying liquidity parameters, network fees, or collateral requirements are discussed and executed. VELO tokens are utilized as governance assets, allowing stakeholders to participate proportionally to their token holdings. While this approach ensures that contributors with vested interests in the platform have a voice, it also introduces potential imbalances in influence, as larger token holders or whale accounts may disproportionately affect decision outcomes.

Community Participation and Coordination Issues

Although decentralized governance aims to distribute decision-making authority among the VELO community, effective participation has proven challenging in crypto ecosystems, including VELO’s network. Governance often sees low voter turnout, which leaves strategic decisions in the hands of a smaller subset of active participants. This dynamic can increase centralization risks, as well-organized or financially motivated groups may dominate decision-making. Moreover, coordinating diverse stakeholder interests remains a persistent challenge, as token holders may prioritize short-term financial gains over the protocol’s long-term health.

Smart Contract Governance Risks

The use of smart contracts to automate governance decisions introduces trust-minimized execution but is not without risks. Coding flaws or vulnerabilities in the governance protocols could be maliciously exploited, leading to severe consequences for the VELO ecosystem. For instance, improper parameter setting or exploiting edge-case scenarios could compromise liquidity pools or collateral configurations. Despite rigorous auditing of governance-related contracts, the risk remains an ongoing concern, particularly in high-stakes, financially complex protocols like VELO.

The Token Distribution Factor

VELO’s token distribution dynamics also impact governance. If tokens are concentrated in specific regions or held predominantly by early investors and institutional players, governance may struggle to reflect the diversity of its global user base. Unequal token dispersion undermines claims of decentralization and diminishes the power of smaller stakeholders to influence key protocol decisions. This issue is further exacerbated if incentives for active participation in governance are insufficient or cumbersome for users at a smaller scale.

Technical future of VELO

Exploring VELO's Current and Future Technical Developments

Cutting-Edge Bridging Solutions: Interoperability Focus

VELO's technical architecture heavily emphasizes interoperability, with its core technology aiming to facilitate seamless cross-chain asset transfers. Using its Federated Credit Exchange Protocol, VELO provides a framework for trusted partners to issue and settle digital credits. While this approach enhances liquidity and accessibility across blockchain ecosystems, the current system still relies on centralized partner validation processes, which can introduce bottlenecks and potential risks regarding decentralization.

Scalability Enhancements: The Push for Layer-2 Integrations

VELO has made strides toward addressing scalability challenges by exploring Layer-2 scaling solutions. Its roadmap indicates that the team is actively experimenting with technologies such as optimistic and zk-rollups to manage congestion and reduce transaction costs. These enhancements could make the platform more efficient for high-frequency users. However, adopting such technologies could bring compatibility challenges and require meticulous testing to ensure a seamless integration with VELO's existing infrastructure.

Advanced Smart Contracts for Automation

VELO is expanding its ecosystem through utility-centric smart contracts for tasks like automated credit issuance, settlement, and dispute resolution. These contracts are designed to eliminate manual intervention and enhance system reliability. That said, smart contract security remains a concern. While the network has conducted audits, the risk of vulnerabilities—especially with the introduction of more complex contract logic—creates potential attack surfaces that the team must continually address.

Decentralization Challenges in Validator Nodes

VELO aims to shift toward a more decentralized validator model to reduce reliance on centralized authority within its ecosystem. Currently, validator participation is somewhat restrictive due to a stringent vetting process, which can deter a wider array of participants. While this ensures a robust and trusted network, it conflicts with the broader ethos of decentralized finance. Future updates are expected to explore ways to democratize access, although no formal timeline has been disclosed.

Roadmap Direction: Oracles and Credit Scoring Systems

One of the standout components of VELO’s future roadmap involves the integration of decentralized oracle networks. These oracles will provide real-time data for credit scoring algorithms, enabling partners to dynamically assess risk. However, the reliance on external oracle providers introduces dependencies that could compromise data integrity if not managed effectively. Additionally, privacy concerns surrounding credit scoring mechanisms and data collection must also be addressed as the network scales.

Financial Interoperability Through API Toolkits

VELO’s technical team is focusing on developer-facing solutions, such as customizable API toolkits, to integrate with existing digital finance systems. This enables institutional partners to seamlessly onboard onto the VELO ecosystem. While these developments are promising for adoption, they raise questions about standardization and backward compatibility with older systems. The onus remains on the developers to simplify these integrations without sacrificing performance.

By focusing on these key areas, VELO continues to iterate on its technology stack while addressing the inherent challenges of decentralization, scalability, and interoperability within its ecosystem.

Comparing VELO to it’s rivals

VELO vs. XRP: How Do They Stack Up in Cross-Border Payments?

In the crowded landscape of blockchain-based payment protocols, VELO and XRP (by Ripple) occupy notable positions, each offering unique solutions for cross-border financial transactions. Both aim to redefine how value is moved internationally, but their methodologies and focus areas diverge significantly. To compare them, let’s break down key dimensions such as technology, use cases, and trade-offs.

Core Technology Differences

VELO operates on a dual-token architecture, leveraging its VELO tokens and digital credit issuance to bridge fiat currencies efficiently. Instead of relying on pure liquidity pools or market makers, VELO utilizes a federated credit model with trusted partners to issue credit, which is backed by VELO tokens locked in smart contracts. This design ensures that liquidity is precisely managed by its network participants, a strategy focused on avoiding over-reliance on external markets.

In contrast, XRP functions as a single-token solution that prioritizes liquidity provisioning through its On-Demand Liquidity (ODL) system. XRP serves as both the bridge currency and the immediate liquidity source for real-time settlement, which reduces the need for pre-funded nostro/vostro accounts—a common bottleneck in traditional banking.

While XRP’s streamlined approach has proven effective for institutional adoption, VELO’s more complex token mechanics aim to provide enhanced scalability for both small and large-scale payment corridors. However, the dual-token system might pose scalability issues for early users unfamiliar with its layered model.

Adoption and Network Composition

VELO explicitly focuses on Southeast Asia as a core region, targeting an ecosystem of financial institutions that deal with fragmented, inefficient remittance systems. Its strong presence in this region gives it a niche advantage over XRP, whose adoption strategy historically leaned toward Western financial institutions and global corridors. VELO’s targeted approach plays well in local economies, but it currently lacks the broader reach of Ripple’s partnerships with high-profile entities like Santander or American Express.

That being said, XRP’s established network dominance comes at the cost of regulatory uncertainty, particularly given its high-profile legal challenges. VELO mitigates this risk by functioning within more cooperative regulatory frameworks through partnerships with licensed remittance providers and financial guardianships in its operating regions. However, the highly regional focus of VELO could limit its global viability in comparison to XRP’s broader ambitions.

Transaction Frameworks

Both VELO and XRP offer extremely fast transactions at relatively low costs, but there are differences in how they manage liquidity. XRP thrives in high-volume, high-volatility corridors due to its deeper liquidity pools. VELO’s federated credit model is potentially more stable for predictable, recurring transactions but may struggle with the sudden liquidity demands required for spontaneous, high-value transfers. Additionally, VELO demands more coordination among its trusted partners to sustain this system, potentially adding administrative overhead compared to XRP’s more autonomous liquidity sourcing.

Decentralization and Control

Though neither network claims to be fully decentralized, VELO utilizes a federated consensus model that requires trusted validators to maintain its ecosystem. XRP, widely criticized for being controlled by Ripple Labs and a select group of validators, has faced debates over how decentralization is truly defined. While VELO’s approach could lead to better long-term governance through its partner network, critics argue that this level of centralization undermines the broader ethos of decentralization.

VELO vs. Stellar (XLM): Decentralized Finance and Remittance Perspectives

When comparing VELO and Stellar (XLM), both cryptocurrencies share a focus on improving cross-border payments and remittances. However, their approach to scalability, decentralization, and adoption within the financial ecosystem reveals several fundamental differences.

Protocol Architecture and Consensus Mechanism

Stellar leverages the Stellar Consensus Protocol (SCP), a Federated Byzantine Agreement (FBA) model designed to achieve consensus through trusted validator nodes. This method sacrifices some decentralization for increased speed and cost-efficiency, a tradeoff that appeals to corporate and institutional partnerships. VELO, on the other hand, employs a federated consensus mechanism but integrates its unique dual-token model, separating utility (VELO tokens) from collateralized value (Velo digital credits). Maintaining this dual-token mechanism adds complexity but provides flexibility in token liquidity and operational use cases.

Stellar’s simplified SCP framework ensures lightweight operations and broad accessibility. However, VELO’s structure may appeal to financial institutions that require greater flexibility in managing liquidity pools and collateralized credit issuance. The downside for VELO is that this complexity increases the barrier to entry for developers unfamiliar with its model, potentially slowing broader adoption.

Use Case Depth and Partner Ecosystem

Stellar’s partner ecosystem includes major players like IBM and MoneyGram, focusing on expanding its reach through well-established institutional integrations. Stellar succeeds in building trust and a global network with its broader aim to serve both small-scale retail users and large enterprises.

VELO, in contrast, targets highly specific use cases in the Asia-Pacific region, particularly in corporate finance, remittance corridors, and decentralized credit issuance. While this regional focus gives VELO a niche advantage, it also limits its global appeal compared to Stellar, which has demonstrated more extensive international adoption.

Tokenomics and Liquidity Management

VELO’s dual-tokenomics design, while innovative, introduces risks concerning adoption and scalability. The collateralized backing of Velo digital credits with fiat assets theoretically reinforces stability for remittance solutions but may be challenging to manage across fluctuating market conditions. In contrast, XLM operates as a single utility token with consistently low costs for transactions, a simpler model that arguably reduces friction for adoption.

Developer Adoption and Ecosystem Growth

When it comes to developer engagement, Stellar’s accessible API and developer tools, such as the Horizon framework, have become relatively user-friendly, fostering broader community involvement. VELO has yet to cultivate a comparable ecosystem of third-party developers, as its specific focus on institutional-grade solutions may inadvertently exclude sizable portions of the open-source developer community.

In conclusion, while VELO and Stellar share overlapping goals, their divergence in implementation, tokenomics, and partnership strategies set vastly different trajectories for their ecosystems. This divergence results in varied opportunities and challenges for these two assets within decentralized finance and remittance.

Comparing VELO to ALGO: A Deep Dive into Performance, Utility, and Consensus Mechanisms

VELO and Algorand (ALGO) occupy distinct positions within the blockchain ecosystem, yet their overlaps in targeting institutional use cases and providing scalable payment solutions make them natural rivals. Both projects aim to deliver robust infrastructure for cross-border transactions and decentralized finance (DeFi). However, significant differences in their technological frameworks, use-case implementations, and adoption raise critical discussion points for crypto enthusiasts and industry players alike.

Consensus Mechanism: Federated Trust vs. Pure Proof-of-Stake

One of the most striking contrasts between VELO and ALGO arises in their consensus mechanisms. VELO’s blockchain operates on the Stellar consensus protocol (SCP) architecture, augmented with a specialized Federated Credit Exchange model. This framework emphasizes centralized nodes to facilitate faster and more consistent throughput but comes with questions regarding decentralization and security if node validators become overly centralized.

ALGO, on the other hand, utilizes Pure Proof-of-Stake (PPoS), a consensus algorithm designed to achieve high decentralization without sacrificing speed or scalability. By randomly selecting validators based on their token holdings, ALGO effectively balances efficiency with trustlessness, though critics argue that high initial token allocations to insiders and institutions undermine its egalitarian ethos. While VELO prioritizes rapid, institutional-grade transaction finality, ALGO’s PPoS is tailored for a broader spectrum of use cases, including governance-heavy decentralized applications (dApps).

Cross-Border Payments: Differentiation in Approach

VELO’s core functionality revolves around a tokenized credit exchange model, in which VELO tokens act as collateral to issue digital credits pegged to fiat currencies. This system targets financial institutions, enabling frictionless settlement while reducing liquidity risks. However, this heavy dependence on trusted issuing partners can be seen as a drawback for purists who value crypto’s core principles of decentralization and censorship resistance.

ALGO takes a more generalized approach by supporting a wide array of stablecoins and tokenized assets directly integrated into its Algorand Standard Asset (ASA) framework. This flexibility has made it popular among issuers of stablecoins and blockchain-based financial instruments. However, critics argue that ALGO’s more generalized infrastructure lacks the focus and tailored optimization for payments that VELO specifically offers, potentially diluting its competitive edge.

Scalability Challenges and Adoption Landscape

VELO emphasizes scalability within its niche vertical, boasting high transaction speeds and low costs while catering specifically to enterprise-grade solutions. ALGO, too, achieves impressive throughput, but its design targets a more diverse audience, from developers to enterprises. While ALGO’s chain is highly scalable, applications built on top of it may still face bottlenecks due to varying degrees of network congestion and tooling limitations.

In conclusion, the comparison between VELO and ALGO highlights fundamental trade-offs in design philosophy. Whether through consensus models, payment system flexibility, or network adoption, each project presents strengths and weaknesses that will appeal to different market segments.

Primary criticisms of VELO

Primary Criticism of VELO: Exploring Key Concerns in Its Ecosystem

VELO, despite its innovative ambitions in the crypto space, has not been immune to criticism. Several issues surrounding its infrastructure, utility, and broader ecosystem have raised concerns among industry experts and blockchain enthusiasts. Below, we explore the primary criticisms frequently directed at VELO.

Questionable Tokenomics and Inflationary Pressures

One of the most prominent critiques of VELO is rooted in its tokenomics model. Critics argue that the token distribution and inflation schedules could cause long-term challenges for the ecosystem. Specifically, there is concern that the release of tokens into circulation, especially through staking rewards or liquidity incentive mechanisms, may lead to downward price pressure and dilute value for long-term holders. This perceived inflationary risk has sparked debates over whether the token’s ecosystem design adequately balances incentivization with sustainability. Additionally, questions surrounding the large allocations for early backers and potential centralization risks have not been fully resolved, further fueling skepticism.

Interoperability and Adoption Gaps

While VELO markets itself as an enabler of cross-border financial settlements, critics are quick to point out the lack of demonstrable interoperability with other blockchain networks at scale. In a crypto ecosystem that is rapidly evolving towards multi-chain compatibility, VELO may struggle to position itself as a versatile solution if it cannot prioritize broader integrations. Furthermore, its adoption metrics for facilitating real-world use cases, such as remittances and payment gateways, have been perceived as underwhelming relative to its ambitions. The gap between roadmap objectives and tangible adoption progress remains a significant point of contention.

Centralization in Governance

Another recurring criticism pertains to the centralized aspects of VELO's governance model. Although blockchain technology is synonymous with decentralization, some industry observers argue that VELO’s early-stage governance structure favors specific entities over the broader community. This could undermine trust among users and raise concerns about decision-making processes being disproportionately influenced by a small subset of stakeholders. Calls for more transparent governance mechanisms and equitable voting rights have grown louder, as decentralization remains a cornerstone principle for many crypto projects.

Scalability Concerns

As VELO attempts to position itself for global scalability in the financial sector, some remain doubtful about its ability to handle transaction throughput at the levels demanded by high-frequency financial applications. Critics argue that the protocol's underlying infrastructure may face bottlenecks under commercial-scale usage, citing concerns about latency, network congestion, and fee structures.

In summary, VELO’s journey is marked by ambitious goals but also a range of valid criticisms from the crypto community that warrant further discussion and analysis.

Founders

The Founding Team Behind VELO: Strengths and Controversies

VELO, a cryptocurrency project operating on the Stellar blockchain, is the brainchild of a team bringing backgrounds in fintech, cross-border payments, and blockchain technology. The founding team has positioned VELO to address inefficiencies in global remittances and bridge gaps in decentralized finance (DeFi) integration. However, scrutiny over the team's centralization, decision-making practices, and long-term transparency has fueled ongoing debates within the crypto community.

At its core, the VELO project was co-founded by Chatchaval Jiaravanon, a member of Thailand’s prominent Charoen Pokphand (CP) Group, and Mike Kennedy, known from his involvement in decentralized finance initiatives. Leveraging Jiaravanon’s established connections in traditional finance and corporate sectors, the project gained early traction, particularly in Southeast Asia’s payment corridors. Meanwhile, Kennedy brought technical expertise, guiding the protocol's design and scaling strategy. The dual leadership model was intended to consolidate strengths in both financial infrastructure and blockchain innovation.

One controversial aspect of VELO’s founding team is its tight integration with traditional financial institutions. While this is seen as a significant asset for bridging crypto and fiat ecosystems, critics argue it undermines the decentralized ethos of blockchain technology. The team’s engagement with corporate stakeholders has led to concerns over potential centralization risks, particularly for a project whose success depends on fostering trust in its decentralized protocol.

Another issue pertains to the opacity of decision-making processes by the founding team. In crypto circles—where open-source collaboration is the gold standard—VELO's semi-closed development environment has frustrated developers seeking greater clarity and input. Furthermore, the team's allocation of VELO tokens and governance rights has come under fire. Critics argue that disproportionate control over governance by early members and institutional partners risks alienating retail investors.

On the other hand, supporters of the founding team argue that their corporate connections are a necessary feature, not a bug. They contend that these ties allow VELO to function as a gateway for blockchain adoption in sectors that remain skeptical about decentralized finance. The team’s ability to win partnerships with entities in banking and remittances demonstrates their focus on adoption rather than crypto purism.

While the founding team's credentials give VELO an edge in institutional adoption, concerns regarding transparency, centralization, and governance remain unresolved. These factors play a critical role in how VELO’s ecosystem is perceived by the wider crypto community.

Authors comments

This document was made by www.BestDapps.com

Sources

- https://www.velo.org/

- https://velo.org/white-paper.pdf

- https://github.com/veloprotocol/velo-core

- https://coinmarketcap.com/currencies/velo/

- https://docs.velo.org/

- https://medium.com/veloprotocol

- https://etherscan.io/token/0x3c44cdddb6a900fa2b585dd299e03d12fa4293bc

- https://bscscan.com/token/0x3ea50b7ef6a7eaf7e966e2cb72b519c16557497c

- https://blog.velo.org/

- https://twitter.com/veloprotocol

- https://www.coingecko.com/en/coins/velo

- https://www.velo.org/technology/

- https://www.velo.org/partners/

- https://www.velo.org/solutions/

- https://www.velo.org/faq/

- https://explorer.velo.org/

- https://cryptoslate.com/coins/velo/

- https://defillama.com/protocol/velo

- https://www.reddit.com/r/VeloProtocol/

- https://nomics.com/assets/velo-velo