A Deepdive into NEXO - 2025

Share

History of NEXO

NEXO Crypto Asset: An In-Depth Look at Its History

NEXO, the native utility token of the Nexo platform, has a history rooted firmly in the evolution of blockchain-powered lending and financial services. Launched by a team of professionals with backgrounds in financial technology and digital asset management, NEXO emerged in response to the growing demand for cryptocurrency-backed credit lines and passive income solutions. However, its journey to becoming a prominent cryptocurrency and utility token has not been without challenges or controversy.

The Nexo platform and its token were introduced in 2018 by Nexo AG, a European financial institution with a mission to bridge traditional finance and blockchain technology. Nexo sought to fill a gap in the crypto industry—it offered a way for users to access fiat loans without liquidating their crypto holdings. Utilizing a collaterization model, the platform enabled borrowers to deposit crypto assets as collateral while receiving instant loans in fiat or stablecoins. The NEXO token was incorporated into this ecosystem, offering holders benefits such as reduced interest rates, higher yields on savings, and dividend payouts.

The initial token distribution occurred through a private sale rather than a public Initial Coin Offering (ICO). This was a strategic decision to avoid regulatory scrutiny, a common concern for blockchain projects at the time. A total supply of 1 billion tokens was minted, with allocations made to private investors, community-based incentives, and operational reserves. Interestingly, the project refrained from significant external funding rounds, instead growing organically by reinvesting platform revenues—a choice indicative of the team's confidence in the product's operational model.

Despite its innovative proposition, NEXO has faced hurdles. Regulatory ambiguity has posed challenges, especially as governments worldwide grapple with the evolving nature of crypto lending platforms. In some jurisdictions, users raised questions about whether Nexo's services complied with securities laws, which prompted Nexo to continuously adapt its terms, services, and municipal licensing strategies. Moreover, the competitive landscape for crypto lending intensified with the emergence of similar platforms such as BlockFi, Celsius, and others, leading to scrutiny of Nexo's ability to differentiate itself both as a utility token and as a platform in an oversaturated market.

Additionally, early adopters of NEXO expressed concerns over the token's liquidity constraints and centralized governance. Nexo's team maintained control over a large reserve of tokens, which critics argued could potentially affect the token's value and market dynamics. Although the team consistently reiterated their commitment to transparency, questions around accountability remain part of the broader discourse on centralized elements within ostensibly decentralized ecosystems.

The NEXO token's history illustrates the complexities associated with building a hybrid financial service product in the crypto domain. While the token and platform have secured a loyal user base and have sustained growth, they remain under the magnifying glass as the regulatory framework around crypto lending continues to evolve.

How NEXO Works

How NEXO Works: A Deep Dive into Its Ecosystem

NEXO operates as a multi-faceted crypto asset within an integrated ecosystem primarily designed for crypto-backed lending and asset management. At the core of the NEXO token's functionality is its role in facilitating seamless borrowing, rewards distribution, and governance—a utility-driven structure with clear mechanisms and distinct trade-offs.

Collateralized Loans and Token Utility

The foundation of NEXO's functionality lies in its role within Nexo's collateralized loan system. Platform users can borrow fiat or stablecoins by putting up their crypto assets as collateral while retaining ownership. Here, the NEXO token plays a dual purpose. First, it acts as a loyalty mechanism: users holding specific percentages of their portfolio in NEXO tokens unlock lower interest rates on loans and higher interest rates on savings accounts. Second, it serves as the platform’s governance token, enabling holders to cast votes on decisions such as profit distributions.

One notable aspect of token usage is its optionality; while NEXO tokens enhance platform benefits, they’re not required for basic functionality. This creates a dichotomy in its utility—users not purchasing NEXO miss out on platform advantages, yet the token's optional nature may lead to questions of integration depth for external users.

Earning Interest and Revenue Distribution

A key component of NEXO’s ecosystem is its interest-earning model. Token holders are incentivized through "Nexonomics," which includes receiving daily payouts of platform revenue in the form of dividends—or interest—distributed in either NEXO or a preferred currency. However, it’s worth noting that these rewards hinge on the Nexo platform's overall profitability and continued user engagement. Critics of the model highlight concerns around sustainability, particularly when token buybacks or high-yield payouts depend on ecosystem growth—a risk if adoption stagnates.

Governance Challenges

Through its publicly stated governance framework, NEXO token holders can participate in decision-making processes. However, questions arise regarding the transparency and actual influence of this governance system. Critics argue that while NEXO holders have voting power, the platform's majority control possibly limits decentralized decision-making—a recurring issue in hybrid DeFi models.

Concerns Around Regulatory Risk

NEXO’s positioning as a borrowing and lending platform also subjects it to nuanced regulatory challenges. Decentralized in name but centralized in custody and operations, the platform inherently runs the risk of compliance concerns, audits, or even future legal restrictions. Users must weigh whether holding NEXO exposes them to potential regulatory uncertainties surrounding securities classifications.

In essence, the success of NEXO’s operational mechanics is closely tied to user engagement, external trust in the platform’s governance, and evolving regulations—highlighting both its strengths and structural vulnerabilities.

Use Cases

Exploring the Use Cases of NEXO: Unlocking Utility in the Crypto Ecosystem

NEXO, the utility token of the Nexo platform, has been specifically designed to enhance users' experience and offer value within its ecosystem. It serves multiple purposes, from enhancing financial services to enabling governance mechanisms, making it a multi-faceted asset for crypto users. Below, we examine some of the key use cases while highlighting potential limitations.

Collateralized Loan Discounts and Benefits

One of the most prominent use cases of the NEXO token is in its ability to grant users access to better terms on collateralized loans offered by the Nexo platform. By holding a specified amount of NEXO tokens, users receive reduced interest rates on loans borrowed against crypto assets. This utility has significant appeal for those frequently accessing crypto-backed credit. However, the discount is tier-based, meaning smaller holders might find the required amounts for top-tier benefits prohibitive. For users who do not want exposure to NEXO for investment or other strategic reasons, this dependence may present a limitation.

Token Staking for Passive Rewards

Another key utility of NEXO is its role in staking, where users can earn daily payouts. These rewards can be paid in either NEXO or other supported cryptocurrencies, adding flexibility to how users interact with the platform. However, staking models may expose users to impermanent losses, particularly if the token faces downward price pressure or if withdrawal terms limit liquidity during market shifts. Additionally, scalability questions arise if staking demand exceeds platform resources.

Governance Voting in the NexoDAO

Through recent implementations, the NEXO token has also entered the realm of decentralized governance. Token holders can participate in the decision-making processes within the NexoDAO framework, granting them influence over the platform's evolution. While this governance mechanism is a step toward decentralization, concerns persist over the voting power being disproportionately skewed toward large holders, potentially undermining equitable participation.

Fee Waivers and Exchange Functionality

NEXO also functions as a medium for fee reductions on internal and partner exchanges. Holding the token can result in lower transaction costs, making it advantageous for regular traders. That said, the scope of these reductions relies heavily on partnerships and platform integrations, which may not consistently align with every user’s needs or preferred trading services.

Cross-Border Transaction Efficiency

While not a primary feature, some users leverage NEXO for cross-border transfers, thanks to its speed and efficiency compared to traditional financial systems. However, its reliance on the broader Ethereum network exposes it to potential bottlenecks like high gas fees during network congestion, which could diminish its appeal as a transfer utility token.

NEXO's diverse applications make it useful for an engaged crypto audience, but its reliance on participation thresholds and external factors highlights both its strengths and constraints as a utility-driven asset.

NEXO Tokenomics

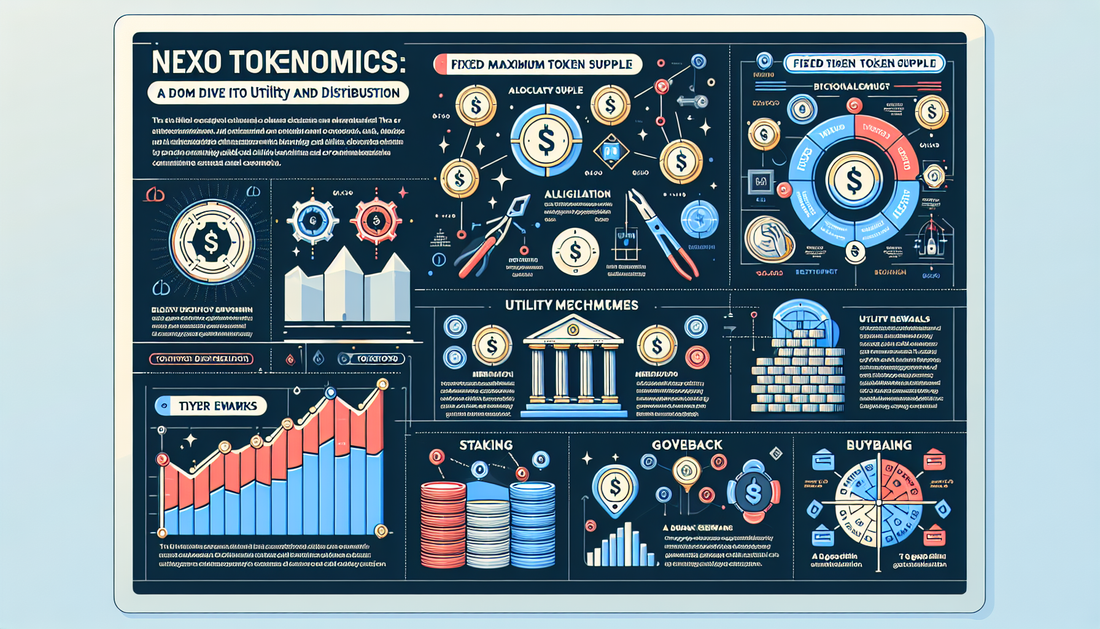

NEXO Tokenomics: A Deep Dive into Utility and Distribution

NEXO is the native utility token of the Nexo platform, designed to enhance user engagement and provide tangible benefits within its ecosystem. Its tokenomics structure is a critical factor in evaluating the asset's role in decentralized finance.

Token Supply and Allocation

The NEXO token has a capped maximum supply of 1 billion tokens. This fixed supply model introduces a deflationary nature to the asset, as no additional tokens can be minted. The distribution was allocated as follows during its inception: 52.5% to public and private token sales, 11.25% to founders and team members, 6% to community building and airdrops, and 30.25% to a reserves fund and operational expenses. While the scarcity created by the capped supply supports token valuation, critics have noted the concentrated allocation to the team and reserves fund as a potential centralization risk.

Token Utility

The NEXO token drives utility through several mechanisms. Token holders benefit from tiered loyalty levels, offering features such as reduced interest rates on crypto-backed loans, higher yields on assets held in Nexo accounts, and increased cashback rewards on card transactions. Additionally, the Nexo platform shares 30% of its net profits as dividends with token holders who opt into the Nexo Token Loyalty Program. While the dividend model adds to NEXO's appeal, it has raised regulatory concerns around whether the token might be classified as a security in some jurisdictions.

Staking and Rewards

NEXO token holders can stake their tokens on the platform to unlock enhanced benefits. The staking rewards are intertwined with the loyalty program, incentivizing users to hold NEXO. However, staking introduces liquidity trade-offs, as users locking tokens cannot capitalize on potential price fluctuations. The platform has also structured incentives in a way that prioritizes large token holders, which could alienate smaller participants.

Buyback Mechanism

One of the notable features of NEXO's tokenomics is its buyback program. The platform periodically repurchases NEXO tokens from the open market using company profits. These tokens are often placed in a reserve for potential distributions or long-term ecosystem development. While the buyback mechanism can reduce circulating supply, thereby supporting market prices, some industry professionals criticize it as an artificial method to maintain token value, particularly in times of low organic demand.

Governance and Control

Despite its utility, NEXO lacks robust decentralized governance features. The platform and its team retain significant decision-making authority over tokenomics changes, fund allocations, and ecosystem developments. This centralized governance structure has sparked skepticism in the crypto community, particularly among proponents of decentralized finance principles.

NEXO Governance

Governance of the NEXO Token: Decentralization vs. Centralized Oversight

The governance of the NEXO token is a topic of ongoing interest for crypto enthusiasts and investors due to its hybrid model of centralized oversight with decentralized elements. Designed primarily as a utility token to offer benefits within the Nexo ecosystem, the NEXO token’s governance mechanisms diverge from fully decentralized protocols, sparking debate about the level of user influence and decision-making power.

Limited Governance Participation

While NEXO token holders are incentivized to engage through staking and reward mechanisms, their governance involvement remains restricted compared to fully decentralized platforms. Decisions related to ecosystem upgrades, feature rollouts, or policy changes within the Nexo infrastructure are largely directed by the core Nexo team. This reliance on centralized decision-making raises concerns about the limitations on user influence in steering the token's trajectory or the broader platform's development.

Lack of On-Chain Voting

Unlike many DeFi-native governance tokens, NEXO lacks a fully functional on-chain voting mechanism. Governance-related decisions are typically communicated publicly but are executed centrally by the Nexo organization. This absence of decentralized consensus-building tools means that token holders cannot directly propose, vote, or execute changes to the platform, undermining the core ethos of decentralization that drives much of the crypto ecosystem.

Transparency Concerns

Another contentious aspect of NEXO governance lies in the degree of transparency during the decision-making process. Token holders receive detailed reports on platform performance and changes—such as the transparency reports Nexo releases—yet they often have no formal say in approving or directing these decisions. This opacity can be a red flag for users seeking higher trust, especially compared to governance systems that rely on open and verifiable community discussions.

Balancing Efficiency with Decentralization

One argument in favor of Nexo’s centralized approach is efficiency. Centralized decision-making allows the platform to react swiftly to regulatory changes, platform upgrades, and security concerns without prolonged governance debates. However, this trade-off between agility and community involvement presents potential risks, particularly if the team’s decisions do not align with the interests of the token holders. Critics of this model often argue that it increases the likelihood of central authority abuse or misaligned priorities, ultimately reducing the attractiveness of the NEXO ecosystem for crypto purists.

Future Governance Scalability

As Nexo continues to grow, there are unanswered questions about how adaptive its governance system is to scale. With more users adopting the platform and greater regulatory scrutiny on crypto centralization, the gap between token holder expectations and the platform's current governance model could widen, potentially impacting community trust and engagement.

Technical future of NEXO

NEXO: Current and Future Technical Developments and Roadmap

The NEXO platform is anchored in its blockchain-based lending ecosystem, which bridges traditional financial services and decentralized technology. As a crypto lending platform, NEXO continuously enhances its infrastructure to ensure scalability, transparency, and security for its users. This section dissects both the current state and anticipated advancements in the technical roadmap.

Current Technical Highlights of NEXO

NEXO’s ecosystem is powered by smart contracts deployed on Ethereum, enabling seamless collateralization, automated loan issuance, and interest payments. The NEXO token itself adheres to the ERC-20 standard, allowing compatibility with a wide array of wallets and DeFi tools. Leveraging on-chain activity and secure APIs, NEXO provides users with access to functions like instant crypto credit lines and exchange services.

One standout feature of the platform is its advanced user wallet, which supports over 40 fiat and crypto assets. This multi-functional wallet integrates deeply with NEXO’s credit and exchange offerings, enabling real-time loan-to-value (LTV) ratio tracking, portfolio performance monitoring, and reward calculations. The wallet also features multi-layered security protocols, including 256-bit SSL encryption and biometric access, catering to its globally distributed user base.

Nevertheless, critics have pointed out that NEXO’s reliance on centralized services to manage lending and custody raises questions about decentralization. While the platform claims to embed transparency measures, including real-time attestation of reserves through third-party audits, concerns surrounding single points of failure persist. Some have also highlighted scalability limitations due to its heavy reliance on Ethereum, which is subject to network congestion and high gas fees.

Future Developments in the NEXO Technical Roadmap

Key priorities in NEXO’s roadmap include multi-chain integration and decentralization of its operations. To reduce its dependency on Ethereum, NEXO developers are actively exploring Layer-2 solutions and compatibility with other blockchain ecosystems like Binance Smart Chain and Avalanche. Such integrations aim to enhance transaction speed, minimize fees, and accommodate a broader range of users.

In addition to scaling solutions, NEXO is iterating towards greater decentralization. The team is reportedly working on migrating certain system components, such as collateral management and governance, onto fully decentralized frameworks. The introduction of a native DAO (Decentralized Autonomous Organization) is an ongoing discussion in further democratizing platform governance.

Lastly, NEXO is placing considerable emphasis on expanding its utility layer by integrating with DeFi protocols and NFT collateralization frameworks. The inclusion of non-fungible token assets and yield-generating DeFi instruments is intended to widen the scope of loan offerings, but it also invites risks tied to the volatility of these emerging asset classes.

Storage improvement, cost-effectiveness, and user-controlled funds are all elements that must be addressed as NEXO strides toward its technically ambitious milestones.

Comparing NEXO to it’s rivals

NEXO vs. Celsius (CEL): A Focused Comparison of Crypto Lending Models

When comparing NEXO with Celsius (CEL), two major players in the crypto-backed lending and earning space, key differences emerge in their business models, lending features, and user-centric focus. Both platforms operate on the concept of earning yield and accessing liquidity through crypto assets, but each has taken distinct approaches that set them apart.

Business Model and Revenue Streams

NEXO positions itself as a hybrid lending ecosystem, primarily offering secured loans backed by crypto collateral, while profiting from interest paid by borrowers. Unlike Celsius, which emphasizes its community-driven “best for the depositor” philosophy, NEXO employs a leaner, profit-centric structure. While this approach offers transparency, critics argue that it could limit the flexibility that Celsius users appreciate. For example, Celsius customers have often highlighted the platform’s attractive loyalty perks based on its CEL token, which incentivize users to hold and stake CEL for better rates. NEXO, on the other hand, focuses on an independent loyalty program built into its platform, tied to NEXO token holdings, with some limitations on customizing preferences.

Yield Generation and Token Utility

Both platforms allow users to earn interest on deposited assets, yet their mechanisms vary. Celsius’s interest rates are often tiered, offering higher rewards for loyalty members staking CEL. In contrast, NEXO employs a dynamic system, with earnings influenced by users’ levels within its loyalty framework (Base, Silver, Gold, or Platinum). While this segmentation provides diversification, some users note that NEXO’s rewards may not always match the flexibility of Celsius’s straightforward structure. Additionally, Celsius’s policy of not charging withdrawal fees has been a competitive advantage, whereas NEXO applies fees unless specific criteria (such as loyalty tier status) are met.

The utility of their native tokens also differs in significant ways. The NEXO token provides benefits like boosted interest rates and reduced borrowing costs, but some critics have pointed out its relatively narrow utility outside the platform. Celsius’s CEL token, though similar in providing platform benefits, has been more fully integrated into a broader ecosystem as a governance and transaction-driving tool. This discrepancy could influence how crypto-savvy users perceive the long-term value of each asset.

Regulatory and Operational Challenges

In terms of regulatory compliance, NEXO takes pride in its adherence to licensing standards in multiple jurisdictions. However, some detractors claim this strict compliance can sometimes result in restrictive Know Your Customer (KYC) processes. Celsius has faced its own controversies, ranging from shifting jurisdictional rules to questions over sustainability in generous yield payouts. Both platforms continue to navigate complex regulatory landscapes, but NEXO appears to focus more intensely on regional certifications, which can be seen as both a positive or restrictive factor depending on user preferences.

In summary, while NEXO and Celsius share common ground in crypto lending, their operational styles, token dynamics, and approach to user incentives make their ecosystems distinct in the eyes of crypto investors and borrowers alike.

NEXO vs. BlockFi: Evaluating Crypto Lending Platforms

When examining NEXO's position in the competitive landscape, a close look at BlockFi reveals critical differences that shape the decision-making process for crypto enthusiasts and institutional investors alike.

Platform Features: Accessibility and Flexibility

Both NEXO and BlockFi operate within the crypto lending and yield-earning ecosystem, but BlockFi’s approach focuses on offering a more traditional, streamlined experience for users transitioning from conventional finance. For example, BlockFi’s offering allows users to earn interest, trade, or borrow against their crypto assets within a less feature-intensive environment. NEXO, by contrast, offers more diverse utilities, such as crypto-backed credit cards and advanced earning tiers based on loyalty levels. While this might appeal to power users, it also introduces complexity compared to BlockFi’s simpler design.

That simplicity, however, comes with trade-offs. BlockFi has historically supported fewer assets for earning interest or securing loans compared to NEXO’s broader roster. This limited asset support can be restrictive for users looking for personalization or diversification.

Regulatory Landscape: Compliance and Scrutiny

A crucial point of distinction is how both platforms have navigated regulatory challenges, particularly in jurisdictions like the United States. BlockFi faced significant legal and regulatory hurdles, including fines levied by the U.S. SEC for its interest-bearing accounts. While NEXO also operates under extensive scrutiny, BlockFi’s publicized regulatory crises and the associated fallout raised questions regarding its operational stability and ability to scale globally. For users prioritizing long-term trust, the impact of such legal complications cannot be ignored.

Interest Rates and Term Structures

BlockFi's interest rates, while competitive, generally lag behind NEXO’s offerings in terms of variability and potential yield. Crucially, BlockFi does not have a native token to provide additional benefits such as rate optimization, unlike NEXO’s loyalty program driven by the NEXO token. Although BlockFi’s flat structure appeals to those seeking simplicity, it lacks the incentives tied to token utility, which can provide significant advantages for crypto-savvy users willing to hold platform-specific assets.

User Concerns and Limitations

Critics of BlockFi frequently point to issues of platform fees and the lack of transparency in how yield is generated. NEXO, while not immune to concerns about transparency, has integrated audits of its reserves, which BlockFi has struggled to match at the same level. Additionally, BlockFi’s limits for stablecoin withdrawals and potential delays in processing times have frustrated users. Comparatively, NEXO offers more fluid access to funds, further differentiating the user experience.

Overall, the competition between these two platforms hinges on the trade-off between simplicity and flexibility, regulatory challenges, and access to features aligned with user needs. Each has its strengths and vulnerabilities depending on the priorities of the crypto investor.

NEXO vs. AAVE: A Deep Dive into DeFi Lending Dynamics

When examining NEXO through the lens of its rivalry with AAVE, the distinctions are rooted in their respective operating models, user focus, and adaptability to the decentralized finance (DeFi) ecosystem. Both projects aim to serve users seeking crypto-backed lending and borrowing, but they approach the market in fundamentally different ways.

Decentralization vs. Centralization

AAVE operates as a fully decentralized protocol, allowing users to engage in peer-to-peer lending and borrowing without requiring intermediary oversight. The platform’s smart contract infrastructure ensures that users maintain control of their funds, adhering to the principles of trustlessness and transparency inherent in DeFi. In contrast, NEXO leans toward a centralized finance (CeFi) model, providing a more curated and user-friendly experience but requiring users to trust the platform to manage custody and lending operations. For seasoned DeFi participants, AAVE's decentralized approach may appeal more due to its self-sovereign ethos, while NEXO caters to those prioritizing convenience and a smooth onboarding process.

Collateral Flexibility and Supported Assets

AAVE offers unmatched versatility in asset selection, supporting a wide range of cryptocurrencies, including lesser-known altcoins and stablecoins. This asset diversity enables users to deposit low-volatility tokens or speculative assets as collateral, depending on their risk tolerance. NEXO, while supporting numerous assets, has a more curated offering, focusing primarily on widely adopted cryptocurrencies. AAVE’s broader ecosystem may be more attractive for crypto-savvy lenders and borrowers looking to utilize niche assets or tokens outside the mainstream.

Yield Strategy and Interest Rates

AAVE introduces dynamic interest rates, determined algorithmically based on supply and demand within its lending pools. This provides a market-driven mechanism, which can result in competitive rates but may also expose users to higher volatility in returns. In comparison, NEXO offers fixed interest rates for certain products, creating predictability but sacrificing the flexibility associated with dynamic rate adjustments. For users accustomed to complex DeFi mechanics, AAVE’s system provides more opportunities for fine-tuning earning strategies, while NEXO’s approach is geared toward simplicity and risk-averse participants.

Governance and Token Utility

AAVE token holders participate actively in governance decisions, such as protocol upgrades and parameter adjustments, reflecting its decentralized ethos. This governance model empowers the community but requires significant engagement from users to fully benefit. On the other hand, NEXO token functionality is embedded in loyalty programs and interest rate discounts but offers limited governance roles. For users interested in shaping the protocol's evolution, AAVE presents a stronger case, while NEXO's token utility is more straightforward and focused on providing immediate benefits to holders.

Smart Contract Risks

AAVE’s transparent, open-source smart contracts are widely praised, but this decentralization also brings about potential vulnerabilities as the code becomes a target for exploits. NEXO, operating on a CeFi model, mitigates such risks by not wholly relying on smart contracts. However, this reliance on centralized systems presents custody risks and a higher level of trust dependency, which may deter privacy-conscious users.

In summary, while NEXO and AAVE both target the lending and borrowing market, their core philosophies diverge significantly, creating distinct user experiences and risk profiles that cater to different segments of crypto users.

Primary criticisms of NEXO

Primary Criticism of NEXO: Challenges Facing the Crypto Lending Platform

Centralized Nature and Custodial Risks

One of the most notable criticisms levied against NEXO is its centralized nature, which places it at odds with the foundational principles of decentralization in the cryptocurrency space. As a custodial platform, NEXO requires users to deposit their crypto assets directly into the platform’s wallets, relinquishing control over their private keys. This creates a single point of failure, raising concerns about potential hacking incidents or misuse of funds. While NEXO asserts that it employs advanced security protocols, critics argue that centralization inherently conflicts with the ethos of user sovereignty that crypto aims to promote.

Transparency Questions Around Reserves

Another recurring point of contention is the perceived lack of transparency surrounding NEXO’s reserves and lending practices. While the platform has repeatedly stated that it maintains full reserves to back customer deposits, skeptics have called for fully audited proof-of-reserve mechanisms to provide verification of these claims. Without a transparent, on-chain verification process, doubts about the platform’s liquidity and solvency remain among more critical members of the crypto community.

Regulatory Uncertainty and Compliance Concerns

NEXO, like many crypto-financial platforms, operates in a rapidly evolving regulatory environment that is fraught with uncertainty. Critics highlight the risk of regulatory crackdowns targeting crypto lending platforms, which could significantly impact NEXO’s ability to operate in certain jurisdictions. Furthermore, some detractors question the platform’s compliance frameworks, expressing concerns over whether NEXO’s business model aligns with emerging regulatory requirements in key markets. Without explicit clarity, users may face long-term risks tied to regulatory enforcement against the platform.

Limited Governance and Token Utility Questions

The NEXO token itself has been another area of criticism, primarily for its restricted governance capabilities and lackluster token utility. While the token provides benefits such as interest rate discounts and profit-sharing mechanisms, some within the crypto space question whether these incentives are sufficient to drive long-term demand or meaningful ecosystem engagement. Others critique the absence of a robust decentralized governance structure, which leaves strategic decisions solely in the hands of NEXO’s corporate team rather than token holders, undermining community participation.

Competition and Market Dynamics

NEXO also faces criticism for its positioning in an increasingly competitive crypto lending market. Detractors argue that alternative projects offering decentralized finance (DeFi) solutions or similar custodial services with greater transparency and user control could erode NEXO’s market share over time. Additionally, competitors often tout more favorable interest rates or superior collateral management systems, forcing some to question whether NEXO can sustain its current user base amidst such competition.

Founders

NEXO Founding Team: A Deep Dive into the Leadership Behind the Platform

The NEXO crypto asset owes its foundation to an experienced team deeply embedded in the fintech and blockchain sectors. The project was co-founded by Antoni Trenchev, Kosta Kantchev, and Kalin Metodiev—individuals with backgrounds that blend expertise in law, finance, and blockchain technology. Examining their experiences is critical for understanding both the strengths and potential vulnerabilities of the ecosystem.

Antoni Trenchev: Bridging Legal Expertise with Blockchain

Antoni Trenchev, one of the co-founders, stands out for his legal and regulatory background. Previously a Member of Parliament in Bulgaria, Trenchev gained significant experience in legislative processes and policy-making, which theoretically positions him to navigate the complex regulatory framework of crypto markets. His role at NEXO emphasizes compliance and strategic partnerships. However, some critics point out that his lack of prior experience running large-scale financial institutions might create challenges as the platform scales globally amid intensifying regulatory oversight.

Kosta Kantchev: The Mind Behind the Technology

Kosta Kantchev serves as another pivotal figure, often credited with spearheading the development of NEXO's technological architecture. With over a decade of experience in fintech, Kantchev’s focus has been on creating scalable, secure, and accessible blockchain-based financial solutions. Despite these achievements, there have been occasional questions regarding transparency in internal development protocols. Especially in a space where trust hinges on open-source contributions and verifiable updates, NEXO has yet to provide a fully transparent roadmap, which fuels skepticism about Kantchev’s long-term approach to technology governance.

Kalin Metodiev: Finance and Risk Management

Kalin Metodiev brings deep financial acumen to the founding team, holding previous leadership roles in investment banking and asset management. Serving as NEXO’s Managing Partner, he is responsible for overseeing liquidity management and risk mitigation strategies. While his experience lends credibility to the asset-backed lending model that NEXO is built upon, some crypto-savvy analysts have raised concerns about how sustainable their risk management practices are, particularly during periods of heightened market volatility or resource-intensive expansion.

Leadership Structure and Potential Criticisms

Although the founding team has demonstrated a mix of talent across law, technology, and finance, the centralization of decision-making has raised eyebrows within decentralized finance (DeFi) circles. Critics argue that an over-reliance on the founding team restricts the community’s ability to influence protocol changes or business strategies. This hierarchical approach contrasts sharply with the ethos of decentralization, a principle many crypto enthusiasts hold in high regard. Such criticisms suggest that the NEXO team must actively work toward balancing operational efficiency with greater community participation.

Authors comments

This document was made by www.BestDapps.com

Sources

- https://nexo.io/

- https://nexo.io/assets/downloads/Nexo-Whitepaper.pdf

- https://etherscan.io/token/0xb62132e35a6c13ee1ee0f84dc5d40bad8d815206

- https://nomics.com/assets/nexo-nexo

- https://coinmarketcap.com/currencies/nexo/

- https://www.coingecko.com/en/coins/nexo

- https://blog.nexo.io/

- https://nexo.io/earn-crypto-interest

- https://github.com/nexofinance

- https://medium.com/nexo

- https://nexo.io/nexo-card

- https://cryptoslate.com/coins/nexo/

- https://trustpilot.com/review/nexo.io

- https://defillama.com/protocol/nexo

- https://research.binance.com/en/projects/nexo

- https://www.sec.gov/

- https://decrypt.co/resources/what-is-nexo-crypto

- https://docs.nexo.io/

- https://dappradar.com/ethereum/defi/nexo

- https://www.financialexpress.com/blockchain/crypto-loans-2023-nexo-review/