A Deepdive into GLCX - 2025

Share

History of GLCX

The History of GLCX: Origins, Developments, and Key Events

GLCX has undergone significant transformations since its inception, shaped by various technological updates, governance shifts, and market dynamics. Initially launched as a response to limitations in existing blockchain ecosystems, GLCX aimed to address scalability and interoperability challenges. The early development phase was marked by extensive research into consensus mechanisms, ultimately leading to the adoption of a modified proof-of-stake model designed to improve transaction efficiency while maintaining decentralization.

Early Adoption and Network Expansion

The initial launch phase saw GLCX gaining traction primarily through developer adoption and community-led initiatives. A key milestone came when the network successfully integrated cross-chain compatibility, allowing seamless interaction with other blockchain ecosystems. This feature positioned GLCX as a potential solution for decentralized applications requiring interoperability—an area where many early blockchain projects struggled.

Network participation increased as staking incentives and governance frameworks were introduced, enabling token holders to influence protocol upgrades. However, this phase was not without challenges; early concerns over validator centralization and governance transparency sparked debates about the long-term sustainability of the ecosystem.

Protocol Upgrades and Scaling Efforts

Over time, multiple protocol upgrades were implemented to enhance network security and transaction throughput. One of the most notable upgrades involved a shift in the network's validation process, reducing block confirmation times and lowering transaction fees. While these improvements bolstered GLCX's efficiency, they also introduced technical hurdles, including backward compatibility issues that required extensive developer intervention.

Another defining moment in GLCX’s history was its approach to dealing with congestion during periods of high on-chain activity. Several proposed scaling solutions, including layer-2 integrations, were explored, though implementation faced delays due to governance disputes and resource allocation challenges. These roadblocks occasionally led to periods of slowed adoption and network congestion.

Security Incidents and Governance Disputes

Like many crypto assets, GLCX has faced security concerns. While not immune to exploits, the network has managed to mitigate significant threats through rapid response mechanisms. However, past governance disputes have highlighted ongoing tensions within its decentralized decision-making framework. Disagreements over protocol changes and consensus modifications have, at times, resulted in temporary forks or stalled development initiatives.

Despite governance-related difficulties, GLCX has continued to evolve, with new proposals frequently emerging to refine its consensus model, on-chain governance, and interoperability features. Throughout its history, the network has balanced innovation with the challenges inherent in decentralized coordination, shaping its current trajectory.

How GLCX Works

How GLCX Works: Consensus, Tokenomics, and Key Mechanisms

GLCX operates on a unique consensus model that combines delegated proof-of-stake (DPoS) with additional off-chain validation layers to optimize scalability and reduce network congestion. Validators are selected through a staking mechanism, where token holders delegate their assets to node operators in exchange for a share of transaction fees and rewards. However, unlike traditional DPoS architectures, GLCX introduces a rotating validator set that adjusts based on network participation metrics, aiming to prevent centralization risks seen in similar ecosystems.

Transaction Processing and Finality

The network utilizes a dual-layer execution system, separating transaction execution from final settlement. Fast transactions are processed off-chain through bundling mechanisms before they are settled on the primary blockchain. This structure is designed to improve transaction throughput but introduces potential concerns about censorship resistance, as off-chain settlement introduces an additional trust assumption.

Finality is achieved through a hybrid model where validators reach consensus through a weighted voting process, incorporating both on-chain stake distribution and historical performance metrics to mitigate malicious behavior. However, the dependency on performance history as a validator-selection mechanism has raised concerns about potential validator centralization, as larger entities tend to accumulate more influence over time.

GLCX Token Utility and Staking Mechanism

The GLCX token serves multiple functions within the ecosystem. It is required for transaction fees, staking, and governance participation. The staking model employs a dynamic slashing mechanism, where penalties are adjusted based on network conditions rather than fixed parameters. This adaptive approach is intended to stabilize the validator set but adds complexity for participants unfamiliar with variable penalty structures.

Governance decisions influence protocol upgrades, validator policies, and fee structures. Proposals require a minimum threshold of staked GLCX to be considered, potentially limiting decision-making power to large stakeholders. This governance model has faced criticism for skewing influence toward early adopters and institutional holders.

Smart Contracts and Cross-Chain Functionality

GLCX employs a modified virtual machine (VM) for smart contract execution, supporting compatibility with multiple blockchain ecosystems. Cross-chain functionality is facilitated through cryptographic state proofs, reducing reliance on centralized bridges. However, the complexity of this system makes integration challenging for developers unfamiliar with its architecture, posing adoption barriers despite its technical advantages.

Security considerations around the cross-chain mechanism remain a point of discussion, particularly regarding potential attack vectors in validating state proofs across heterogeneous blockchains. While GLCX's approach minimizes reliance on custodial intermediaries, it does not fully eliminate trust assumptions in cross-chain execution.

Use Cases

GLCX Use Cases: Applications and Utility in the Ecosystem

On-Chain Governance and Voting

GLCX plays a key role in on-chain governance, allowing token holders to participate in protocol upgrades and network decisions. Governance participation often requires staking GLCX to propose changes or vote on various parameters, such as transaction fees, consensus mechanisms, or treasury allocations. However, governance power can become centralized if a small number of whales accumulate a majority of tokens, leading to concerns about fair representation in decision-making.

Transaction Settlement and Gas Fees

GLCX is used for transaction fees within its native blockchain environment. Whether executing smart contract operations, transferring assets, or interacting with dApps, GLCX serves as the network’s primary gas token. However, network congestion can lead to significant fee fluctuations, making certain use cases less predictable in terms of cost. Projects built on top of the blockchain must account for these dynamics when designing applications that rely on consistent transaction costs.

Collateral in DeFi Protocols

Many DeFi platforms accept GLCX as collateral for lending and borrowing, enabling users to lock up tokens in exchange for stablecoins or other crypto assets. This mechanism allows for increased liquidity while maintaining exposure to GLCX. However, liquidation risks arise when collateralization ratios drop below required thresholds, exposing users to potential losses. Additionally, GLCX’s volatility can affect borrowing costs and capital efficiency in lending markets.

Staking and Network Security

GLCX is critical to the network’s staking mechanism, where participants lock up tokens to support consensus and earn staking rewards. This incentivizes long-term holding but introduces staking lock-up periods, reducing liquidity for participants. Additionally, validator centralization is a potential issue if token distribution is uneven, leading to security risks if a small group controls a significant portion of staked funds.

Cross-Chain Interoperability

GLCX is integrated with various cross-chain bridges, allowing users to transfer value across different blockchain networks. This enhances liquidity and utility but also introduces security challenges, as cross-chain bridges have historically been targets for exploits. Users engaging in cross-chain transactions with GLCX must consider potential risks related to smart contract vulnerabilities and custody mechanisms.

Utility Within dApp Ecosystems

Various dApps within the GLCX ecosystem utilize the token for micropayments, rewards, and in-app functionalities. From gaming applications that require GLCX for in-game assets to NFT marketplaces where it serves as a payment method, the token’s utility spans multiple sectors. However, adoption hinges on network scalability and the ability to handle a high volume of transactions without high fees or slow confirmation times.

GLCX Tokenomics

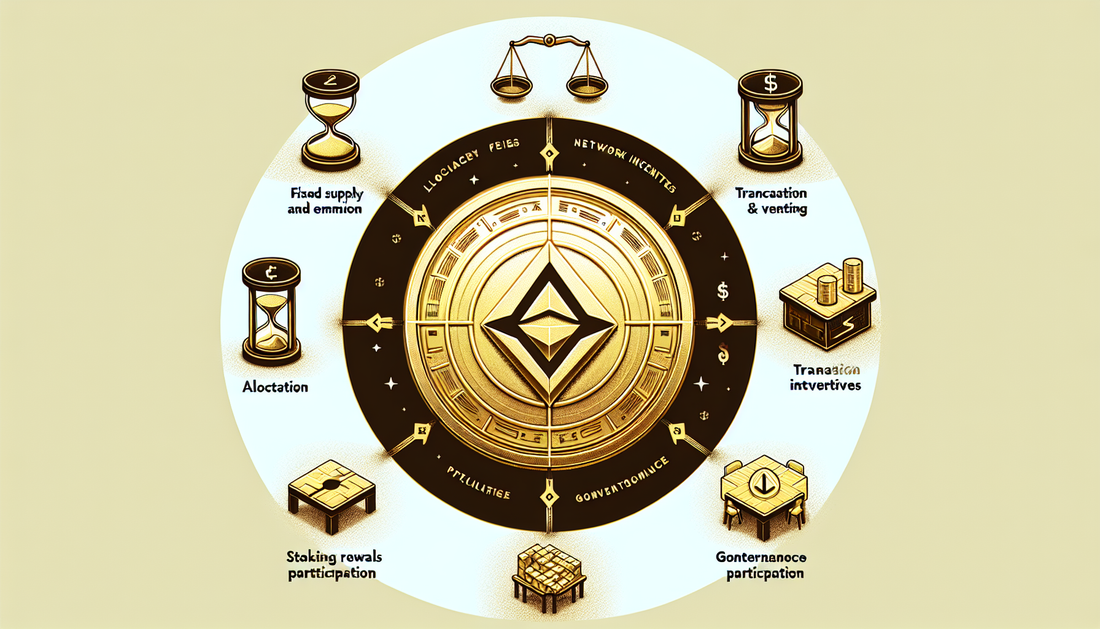

GLCX Tokenomics: Supply Structure, Utility, and Distribution

Fixed Supply and Emission Schedule

GLCX operates on a fixed supply model, ensuring a predetermined total issuance with no capability for inflationary adjustments. The total token supply is capped, with a predefined emission schedule that dictates initial distribution, staking rewards, and ecosystem incentives. The absence of a mint function prevents any additional issuance beyond the original allocation, solidifying its deflationary nature over time. However, concerns exist around token centralization due to early-stage distributions and concentrated holdings among select entities.

Allocation and Vesting Mechanisms

Token allocations are split across multiple categories, including ecosystem incentives, developer funds, governance participants, and liquidity provisions. A structured vesting schedule exists for early adopters, ensuring a gradual release of tokens to prevent immediate sell pressure. Despite these mechanisms, historical vesting unlocks have occasionally led to short-term volatility, as periodic increases in liquid supply create temporary sell-side pressure.

Transaction Fees and Network Incentives

GLCX employs a dual-fee structure, combining base network fees with optional priority fees for faster execution. A portion of transaction fees is redistributed to validators and stakers, reinforcing network security and participation. However, fee stability remains a challenge, as congestion-driven fee spikes could impact usability for lower-value transactions. Additionally, while fee-burning mechanisms exist, they have yet to consistently counterbalance inflationary forces from staking rewards.

Staking Rewards and Inflation Control

GLCX integrates a staking model where users can delegate tokens to validators in exchange for protocol-native rewards. While staking serves as a core mechanism for securing the network, variations in reward rates have led to fluctuations in participation. The staking yield competes with alternative DeFi opportunities, creating instances where users unstake to pursue external yield strategies. Slashing mechanisms exist to penalize validator misbehavior, but concerns remain regarding long-term staking incentives if yields fail to remain competitive.

Governance Participation and Token Weight

GLCX holders have governance rights, allowing them to participate in protocol decisions regarding upgrades, fee structures, and network policies. However, governance participation has historically been influenced by a minority of large-scale token holders, leading to concerns over decentralization. While governance staking is an incentive for participation, low voter turnout remains a recurring issue, potentially consolidating decision-making power among a small subset of stakeholders.

GLCX Governance

GLCX Governance: On-Chain Mechanisms and Decentralized Decision-Making

GLCX operates with a governance framework designed to facilitate decentralized decision-making, ensuring that token holders have direct input into protocol changes, upgrades, and treasury allocations. The structure relies heavily on on-chain governance, where voting power is directly linked to token holdings, allowing GLCX stakeholders to propose and vote on governance initiatives.

Governance Token Utility and Voting Power

GLCX governance is structured around its native token, which serves as the primary mechanism for voting. Token-weighted voting determines the outcome of governance proposals, meaning holders with more GLCX tokens wield greater influence. While this aligns incentives with those most invested in the network, it also raises concerns about governance centralization, as large holders or entities with significant token stakes can disproportionately sway decisions.

Proposal Process and Smart Contract Execution

Governance in GLCX follows a proposal-based model, where network participants can submit improvement proposals that, if approved, are automatically executed via smart contracts. This eliminates the need for intermediaries and ensures that governance updates are implemented transparently. However, this model also introduces risks—poorly designed or malicious proposals could be executed if they receive enough support from influential token holders.

Voter Participation and Delegation Challenges

One ongoing issue with GLCX governance is voter participation. While token-based voting provides transparency, historically, decentralized governance models have struggled with low engagement from smaller holders. To address this, GLCX allows for vote delegation, enabling users to delegate their voting power to trusted representatives. While this helps improve governance efficiency, delegation also introduces centralization risks, as prominent delegates may accumulate overwhelming influence over decision-making.

Governance Security and Attack Vectors

Since all governance actions are executed on-chain, the system is susceptible to governance attacks, such as token accumulation by external actors seeking control over the protocol. Additionally, time-delay mechanisms intended to allow for community oversight before changes are implemented can be exploited by malicious actors, who may use sudden shifts in voting power to pass contentious proposals before the community can react.

Treasury Management and Fund Allocation

Funds from the GLCX treasury are allocated based on governance votes, which allows the community to direct resources toward development, ecosystem growth, or incentive programs. However, treasury management decisions also reflect governance power dynamics, as well-funded entities can push through proposals that favor their interests over the broader community.

GLCX governance remains an evolving mechanism, balancing decentralization with practical decision-making while addressing security risks and voter engagement challenges.

Technical future of GLCX

GLCX Technical Developments and Roadmap

Core Protocol Enhancements

GLCX continues to refine its core protocol, focusing on scalability and efficiency. Upcoming upgrades target reduced block finalization times, optimizing consensus mechanisms for faster transaction throughput without compromising network security. Discussions within developer circles indicate potential modifications to the staking algorithm, aimed at incentivizing long-term network participation while mitigating centralization risks. However, balancing validator incentives with decentralization remains a challenge, particularly as validator pools consolidate.

Layer 2 Scaling and Interoperability

A key technical focus is Layer 2 integration, addressing congestion and high transaction costs. The development team has explored roll-up solutions to improve processing speeds, with zk-rollups and optimistic rollups both under evaluation. The viability of these solutions depends on smart contract compatibility and maintaining trustless security assumptions without introducing excessive dependence on external sequencers. Cross-chain functionality remains a priority, with bridge mechanisms under scrutiny for security vulnerabilities, especially given past exploits on similar networks.

Smart Contract and dApp Ecosystem Expansion

GLCX's smart contract framework is undergoing enhancements to improve developer experience and execution efficiency. Proposal discussions include introducing a more optimized virtual machine (VM) for smart contracts, potentially improving gas efficiency. Additionally, updates to developer tooling, such as SDK improvements and stronger debugging features, are in progress to encourage more robust dApp development. A lingering concern is the potential complexity of migrating existing contracts to newer VM iterations, which could create fragmentation challenges.

Governance Mechanism Evolution

Decentralized governance is receiving updates to refine proposal validation and voting mechanisms. There has been debate over extending governance participation beyond native token holders, possibly incorporating multi-token weighted voting or reputation-based systems. The risk, however, lies in potential governance attacks if weighting mechanisms are poorly implemented. Smart contract-based governance modules are under active development, with focus on reducing attack vectors related to treasury fund allocation.

Privacy and Security Initiatives

Ongoing research into on-chain privacy enhancements is a key roadmap component. Zero-knowledge proofs (ZKPs) and trusted execution environments (TEEs) are among the proposed solutions for confidential transactions. However, regulatory uncertainties surrounding privacy features could impact implementation, particularly if compliance requirements conflict with permissionless privacy protocols. Meanwhile, security audits remain a routine focus, with independent third-party firms evaluating smart contract vulnerabilities and protocol-level attack vectors.

Comparing GLCX to it’s rivals

GLCX vs BTC: A Detailed Comparison

Consensus Mechanism and Network Security

GLCX and BTC differ significantly in their consensus mechanisms. BTC relies on Proof of Work (PoW), a battle-tested algorithm that prioritizes security through decentralized mining. This model has made Bitcoin the most secure blockchain, but also the most energy-intensive. In contrast, GLCX implements a modified Proof of Stake (PoS) mechanism, drastically reducing energy consumption and enabling faster transaction finality.

However, PoS systems like the one employed by GLCX introduce different security trade-offs. While they eliminate the need for expensive mining hardware, they consolidate control among large token holders. This raises concerns about centralization risk, especially if governance is not sufficiently decentralized.

Transaction Speed and Fees

BTC’s transaction processing time remains one of its biggest limitations. With an average block time of ten minutes and scaling challenges on the base layer, transactions can often experience significant delays unless users pay high fees. This congestion has driven demand for layer-2 solutions like the Lightning Network, which aims to provide faster payments at lower costs.

GLCX, in contrast, offers quicker settlement times directly on its base layer. Thanks to its PoS architecture, blocks are produced faster, reducing wait times for confirmations. Additionally, transaction fees on GLCX are typically lower than BTC’s base layer fees. However, if network demand surges, GLCX’s fee structure can become unpredictable, making cost estimation more complex compared to Bitcoin’s traditionally transparent fee market.

Supply Dynamics and Inflation Control

One of BTC’s strongest value propositions is its fixed supply of 21 million coins. This hard cap creates a known scarcity, reinforcing Bitcoin’s position as “digital gold.” Miners continue to secure the network while block rewards gradually decrease over time, leading to a deflationary economic model.

GLCX follows a different monetary design. While it also employs a controlled issuance mechanism, its token supply is not fixed in the same manner as BTC. Instead, the long-term emission schedule depends on staking participation and governance decisions. This introduces a layer of flexibility that can be advantageous for network incentives but may also lead to inflationary risks if not properly balanced.

Smart Contract Capabilities

Unlike BTC, which operates primarily as a store of value and medium of exchange, GLCX incorporates smart contract functionality at the protocol level. This allows developers to build decentralized applications (dApps) without relying on additional layers. While this expands GLCX’s utility, it also introduces additional attack vectors, including potential vulnerabilities in smart contract execution. BTC, by contrast, maintains a minimalistic script language, which significantly reduces its attack surface but limits its programmability.

GLCX vs. ETH: Key Differences in Architecture and Performance

Ethereum (ETH) remains dominant in the smart contract space, but GLCX brings a different approach that impacts scalability, execution efficiency, and consensus. The comparison between the two highlights critical trade-offs in network architecture, gas mechanics, and validator incentives.

Consensus and Network Structure

Ethereum transitioned to Proof of Stake (PoS), which removed miners and replaced them with validators who stake ETH to secure the network. While this dramatically reduced its energy consumption, it introduced centralization concerns with large staking pools controlling significant portions of the validation process. GLCX approaches consensus differently, implementing a modified algorithm that reduces finalization times without relying on large validator node requirements. The result is a different set of decentralization and security trade-offs that shift power dynamics within its ecosystem.

Smart Contract Execution and Gas Efficiency

A core efficiency issue within Ethereum is gas fee predictability and spikes during high network demand. While improvements like EIP-1559 introduced base fees, network congestion still results in volatile pricing. GLCX implements a distinct transaction prioritization mechanic that reduces execution uncertainty, particularly for DeFi and NFT-related contracts. However, this comes with its own challenges since its execution environment is less standardized across multiple scaling layers, which can lead to developer fragmentation.

Scalability Differences

Ethereum’s roadmap relies heavily on Layer 2 solutions such as rollups for scaling transaction throughput. These solutions work but introduce added complexity for users who need to bridge assets between Layer 1 and Layer 2. GLCX, instead of fully outsourcing scalability to Layer 2 networks, integrates a more on-chain scaling approach that improves throughput at the base layer. This method removes some of the friction of external rollups but also places more pressure on its core validation model, potentially impacting long-term network stability.

Ecosystem and Developer Experience

Ethereum benefits from having a deeply entrenched developer ecosystem with tooling like Solidity, Vyper, and major integrations across DeFi protocols. GLCX, despite introducing efficiency improvements, faces adoption barriers as its smart contract environment differs from Ethereum’s Virtual Machine (EVM). This means developers cannot directly port Ethereum-based applications without modifications, which slows adoption and splits liquidity between ecosystems.

Each of these aspects—consensus, gas structure, scalability, and developer experience—presents clear contrasts between the two networks, shaping their respective use cases and adoption paths.

GLCX vs. Solana (SOL): Speed, Scalability, and Network Trade-offs

When comparing GLCX to Solana (SOL), the most immediate contrast lies in their approach to scalability and transaction processing. Solana's proof-of-history (PoH) mechanism enables extremely high throughput, frequently surpassing competitors in raw transactions per second. However, this speed comes with trade-offs in decentralization and network stability, two areas where GLCX positions itself differently.

Network Performance and Stability

Solana's high-speed architecture relies on its delegated proof-of-stake (DPoS) model, but network reliability has been a persistent issue. Outages and congestion events have led to concerns about its ability to maintain uptime during peak demand. GLCX, in contrast, implements a different consensus structure designed to improve fault tolerance and prevent downtime-related failures.

Despite Solana’s optimizations for fast execution, its reliance on a small number of high-performance validators has raised concerns about centralization. A streamlined validator set means fewer participants are responsible for securing the network, which, while efficient, introduces questions about censorship resistance compared to GLCX, which distributes validator power more evenly.

Smart Contract Execution and Developer Support

Solana’s execution environment benefits from low-latency transaction processing, making it appealing for DeFi platforms and NFT marketplaces. However, its programming model, based on Rust, has a steeper learning curve compared to the more widely adopted environments of competitors. GLCX aims to improve on this by offering broader compatibility with existing smart contract frameworks, reducing the barrier to entry for developers transitioning from other ecosystems.

Another factor impacting development on Solana is tooling and documentation. While improving, some developers have reported friction with debugging and building complex applications. GLCX looks to differentiate itself by enhancing usability, providing better compilation tools, and reducing the possibility of smart contract execution failures due to network congestion.

Fee Structure and Cost Efficiency

Solana is known for its low transaction costs, which has been one of its strongest advantages over networks struggling with high gas fees. However, this cost efficiency comes with concerns about spam transactions and network load. The lack of sustainable fee-burning mechanisms or congestion pricing can sometimes lead to instability. GLCX confronts this issue by implementing a dynamic fee model designed to deter spam while maintaining predictable costs for legitimate transactions.

Tokenomics and Liquidity Dynamics

Solana’s tokenomics are structured around inflationary rewards for validators and staking participants. While this incentivizes participation, it also introduces long-term concerns about value dilution. GLCX employs a different issuance and reward model, aiming for a more controlled supply mechanism that balances validator incentives with tokenholder value retention.

Liquidity depth is another consideration. With Solana's integration into major DeFi ecosystems, it benefits from strong liquidity channels, but this can fluctuate with network performance. GLCX’s approach seeks to establish a more resilient liquidity foundation by diversifying market-making incentives and reducing dependency on centralized exchange listings.

Primary criticisms of GLCX

Primary Criticism of GLCX

Concerns Over Centralization Risks

Despite GLCX being marketed as a decentralized asset, critics argue that a significant portion of its network operations and governance remain under the control of a concentrated group of stakeholders. Validator distribution has been flagged as a potential weakness, with a handful of entities controlling a disproportionate share of the staking power. This raises concerns about censorship resistance, security, and the possibility of governance manipulation.

Smart Contract Vulnerabilities and Code Auditing Limitations

While GLCX promotes innovation through its smart contract functionality, security researchers have pointed out flaws in its audit history. Some decentralized applications (dApps) on the network have suffered from exploits, questioning the thoroughness of the ecosystem’s auditing processes. Issues ranging from reentrancy vulnerabilities to logic flaws have led critics to highlight the need for more stringent third-party code reviews.

Scalability Tradeoffs and Network Congestion

GLCX has made significant strides in improving transaction speeds, but this has not eliminated concerns about scalability. Under high-load conditions, network congestion has resulted in increased fees and slower confirmation times, undermining the efficiency that GLCX aims to provide. Critics argue that while the roadmap includes scalability improvements, current implementations still fall short of handling widespread adoption without bottlenecks.

Tokenomics and Inflationary Pressure

A number of analysts have expressed concerns over GLCX’s token issuance model and its long-term inflationary impact. While incentivizing network participants is necessary, the rate of token emissions has raised questions about potential dilution of value. Additionally, some have pointed to discrepancies in reward distributions, which may disproportionately favor early adopters over new entrants, creating long-term inequality in the ecosystem.

Regulatory Uncertainty and Compliance Risks

Like many blockchain projects, GLCX faces scrutiny over regulatory compliance, particularly in jurisdictions with evolving legal frameworks around crypto assets. Questions regarding its categorization—whether as a security, utility token, or something else—have fueled debates about potential enforcement actions that could impact its accessibility. Some exchanges have already placed restrictions on GLCX trading in specific regions due to compliance concerns, adding another layer of uncertainty for investors and developers within its ecosystem.

Adoption Challenges and Ecosystem Fragmentation

While GLCX has positioned itself as a competitive player, adoption remains an ongoing challenge, particularly against more established blockchain networks. Some critics argue that its developer community is fragmented, with competing standards and frameworks making it difficult for projects to achieve interoperability. This has led to difficulties onboarding new developers, limiting the pace at which the ecosystem can grow and integrate with other blockchain solutions.

Founders

GLCX Founding Team: Key Figures and Controversies

The founding team behind GLCX consists of a mix of experienced blockchain engineers, cryptography experts, and former traditional finance professionals. The project was initiated by a core group of developers who had previously worked on Layer 1 blockchain infrastructure, claiming to bring significant technical advancements to scalability and security. However, despite their technical backgrounds, the team has faced questions regarding transparency and decision-making processes.

Core Founders and Backgrounds

GLCX was co-founded by a former lead developer from a well-known Layer 1 protocol, a cryptographic researcher who previously contributed to zero-knowledge proof developments, and a serial entrepreneur with deep roots in fintech startups. While they have notable experience in blockchain and finance, some early backers have expressed concerns about the project’s centralized decision-making, particularly in its token distribution model and governance structure.

One area of contention has been the departure of a key cryptography expert within the first year of the project. This exit raised concerns about the team’s internal conflicts, though no official explanations were provided. Some community members speculate that disagreements over protocol design and governance were behind the split.

Anonymity and Transparency Issues

Unlike some blockchain projects that operate with full transparency regarding founders and core developers, GLCX has maintained a semi-anonymous approach for certain team members. While a few co-founders have been publicly identified, several of the technical leads and advisory board members remain pseudonymous. This lack of full disclosure has fueled skepticism within the crypto community, especially in discussions around accountability and long-term project commitment.

Concerns have also been raised about the team’s responsiveness to community input. While GLCX initially promoted a decentralized governance model, in practice, most major protocol decisions have been driven by a small insider group. Attempts to introduce community-driven decision-making mechanisms have been slow to materialize, leading to ongoing debates about whether the project is as decentralized as originally promised.

Early Investor Influence

Initial funding for GLCX came from a limited group of private investors, including high-profile VC firms specializing in crypto assets. While this provided financial stability during the project’s early stages, it also led to concerns about potential influence from institutional stakeholders. Some blockchain purists view this as a conflict with the project’s decentralization ethos, worrying that large token holders may have disproportionate control over governance decisions.

Authors comments

This document was made by www.BestDapps.com

Sources

https://glcx.io/whitepaper

https://glcx.io/yellowpaper

https://glcx.io

https://docs.glcx.io

https://explorer.glcx.io

https://github.com/glcx-project

https://medium.com/glcx-official

https://twitter.com/glcx_official

https://discord.gg/glcx

https://t.me/glcx_community

https://defillama.com/protocol/glcx

https://coinmarketcap.com/currencies/glcx

https://www.coingecko.com/en/coins/glcx

https://dune.com/glcx/glcx-metrics

https://etherscan.io/token/glcx

https://bscscan.com/token/glcx

https://app.uniswap.org/#/swap?outputCurrency=GLCX

https://curve.fi/glcx

https://snapshot.org/#/glcxdao.eth

https://research.glcx.io